As a leading global aerospace company, Boeing has been a benchmark for innovation and excellence in the industry. With a rich history spanning over a century, the company has consistently demonstrated its ability to adapt and evolve, making it an attractive opportunity for investors. In this article, we will delve into the world of Boeing Company, providing an overview of its investment landscape and highlighting the key factors that make it an appealing choice for investors.

Company Profile

The Boeing Company is an American multinational corporation that designs, manufactures, and delivers commercial airplanes, defense, space, and security systems. Founded in 1916, Boeing has grown to become one of the largest and most successful aerospace companies in the world. With a global presence, the company employs over 140,000 people and generates annual revenues of over $100 billion.

Investor Highlights

Boeing's strong financial performance, diversified portfolio, and commitment to innovation make it an attractive investment opportunity. Some key highlights for investors include:

Consistent Dividend Payments: Boeing has a long history of paying consistent dividends to its shareholders, providing a stable source of income.

Strong Cash Flow: The company generates significant cash flow from its operations, which is used to invest in growth initiatives and return value to shareholders.

Diversified Portfolio: Boeing's portfolio spans commercial airplanes, defense, space, and security systems, reducing dependence on any one market or customer.

Innovation and R&D: The company invests heavily in research and development, driving innovation and staying ahead of the competition.

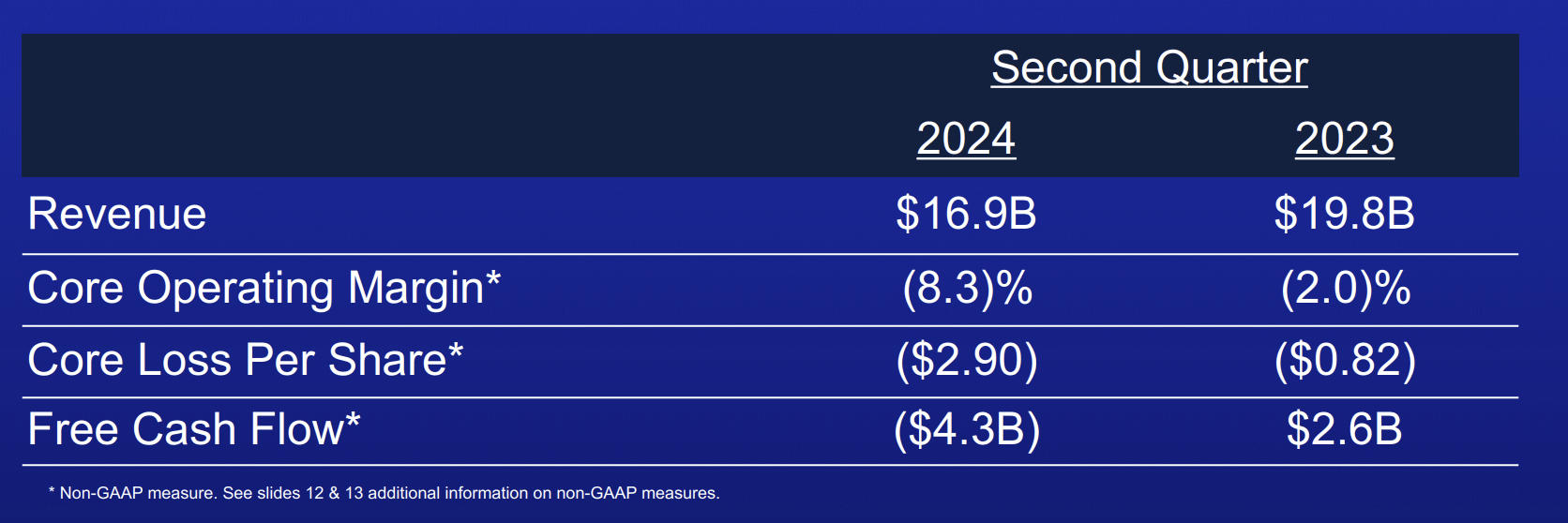

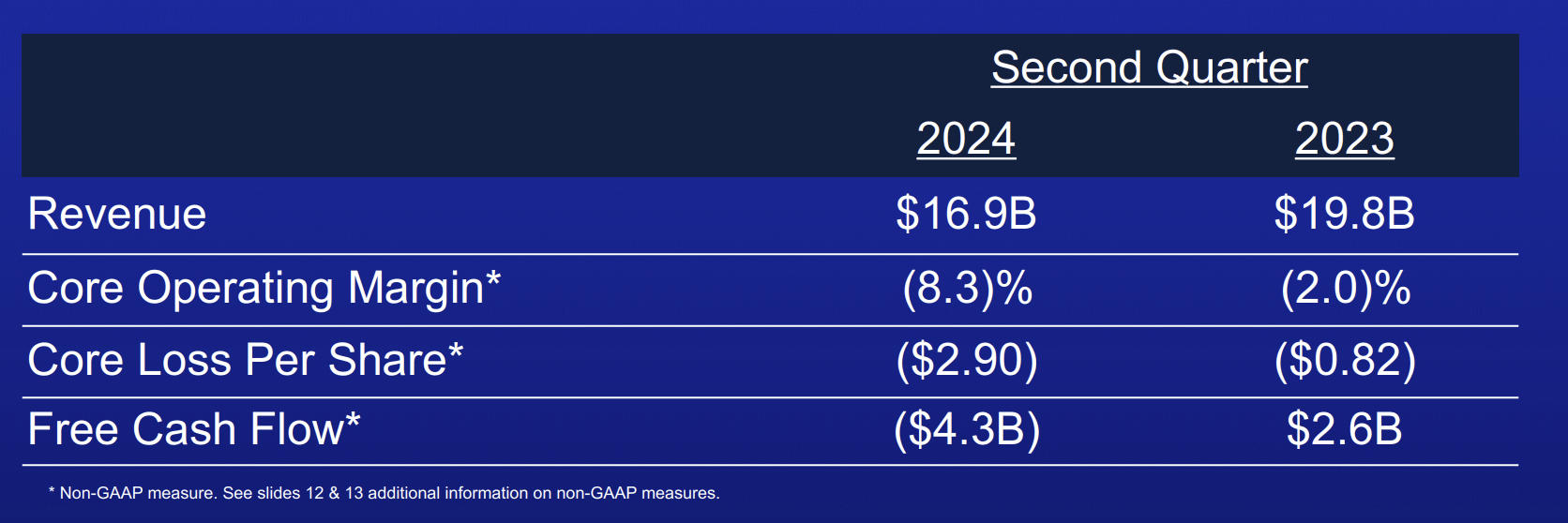

Financial Performance

Boeing's financial performance has been strong in recent years, with the company reporting consistent revenue growth and profitability. Some key financial metrics include:

Revenue Growth: Boeing's revenue has grown steadily over the years, with the company reporting $101.1 billion in revenue in 2020.

Net Income: The company reported a net income of $4.3 billion in 2020, demonstrating its ability to generate profits.

Return on Equity (ROE): Boeing's ROE has consistently been above 20%, indicating strong returns for shareholders.

Investment Opportunities

Boeing offers a range of investment opportunities, including:

Common Stock: Investors can purchase Boeing's common stock, which is listed on the New York Stock Exchange (NYSE) under the ticker symbol BA.

Dividend Reinvestment Plan: The company offers a dividend reinvestment plan, allowing investors to automatically reinvest their dividends in additional shares.

Employee Stock Purchase Plan: Boeing's employee stock purchase plan allows employees to purchase company stock at a discounted price.

In conclusion, Boeing Company offers a compelling investment opportunity for those looking to tap into the growth potential of the aerospace industry. With its strong financial performance, diversified portfolio, and commitment to innovation, Boeing is well-positioned for long-term success. Whether you're a seasoned investor or just starting out, Boeing's investment landscape has something to offer. As the company continues to evolve and adapt to changing market conditions, it's an exciting time to consider investing in Boeing.

Note: This article is for informational purposes only and should not be considered as investment advice. Investors should conduct their own research and consult with a financial advisor before making any investment decisions.