As the tax season approaches, it's essential to understand the importance of filing your taxes on time to avoid penalties and ensure you receive your refund promptly. The Internal Revenue Service (IRS) has specific deadlines for filing tax returns, and it's crucial to know when to file to avoid any complications. In this article, we'll guide you through the process of determining when to file your taxes with the IRS.

Individual Tax Filing Deadlines

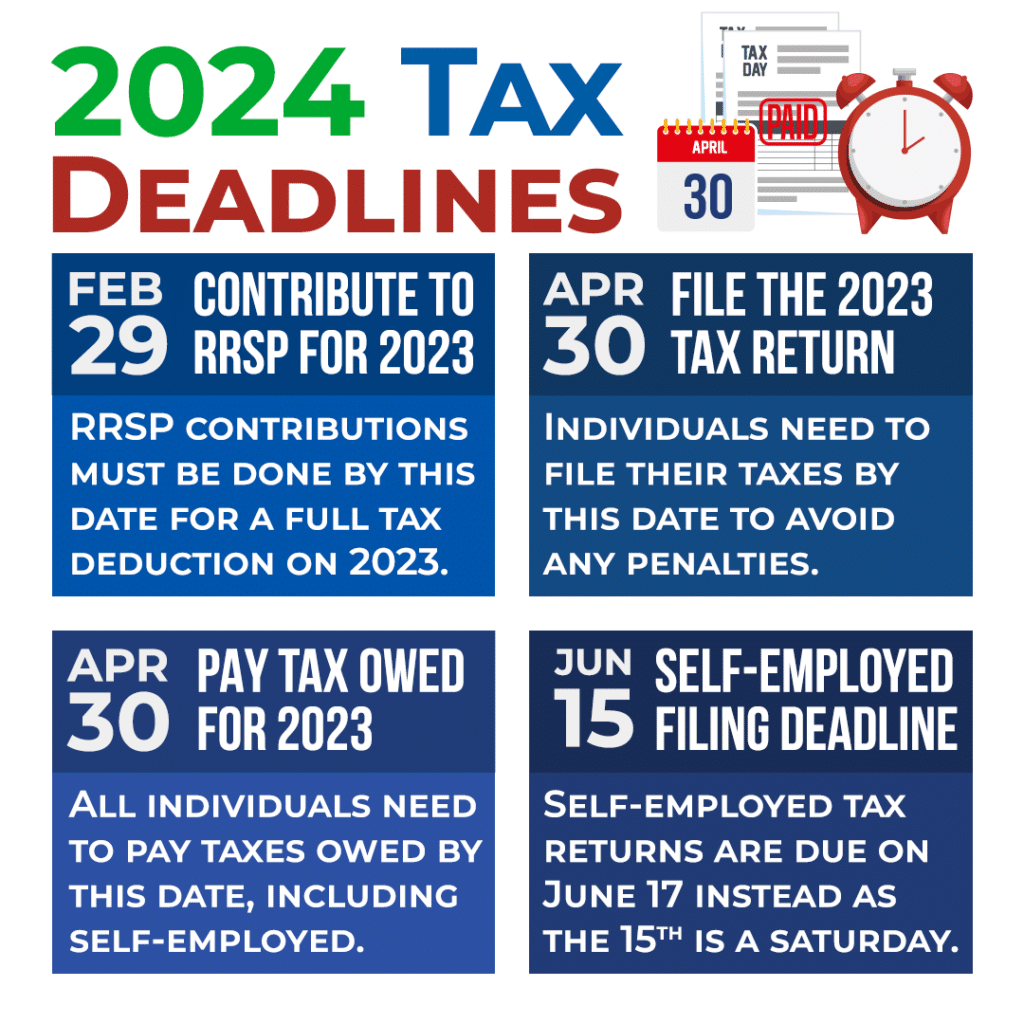

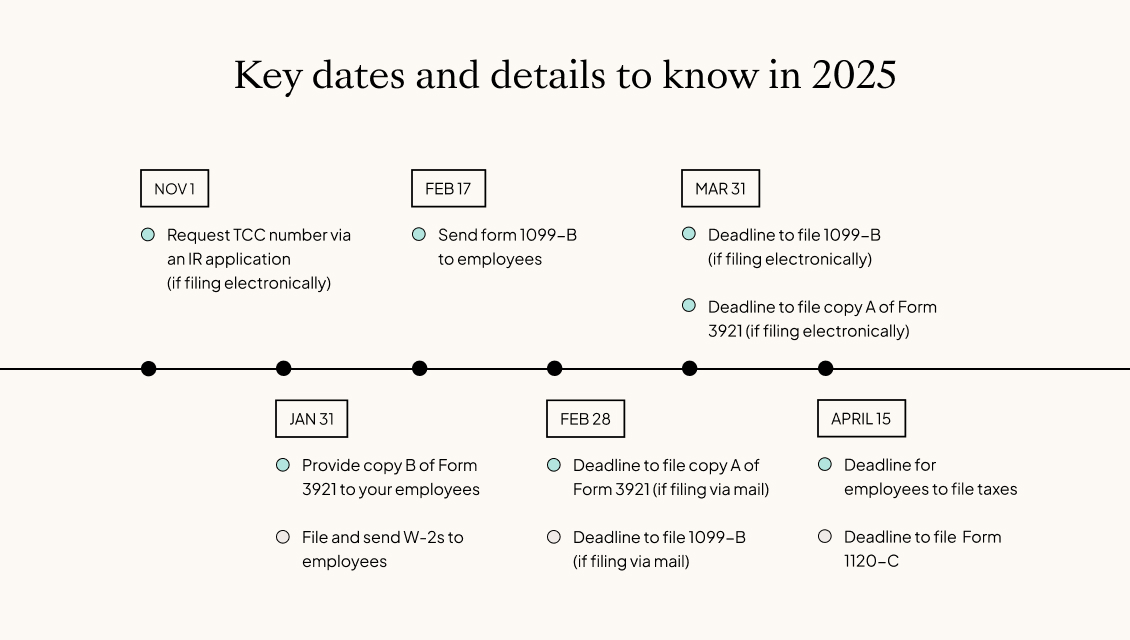

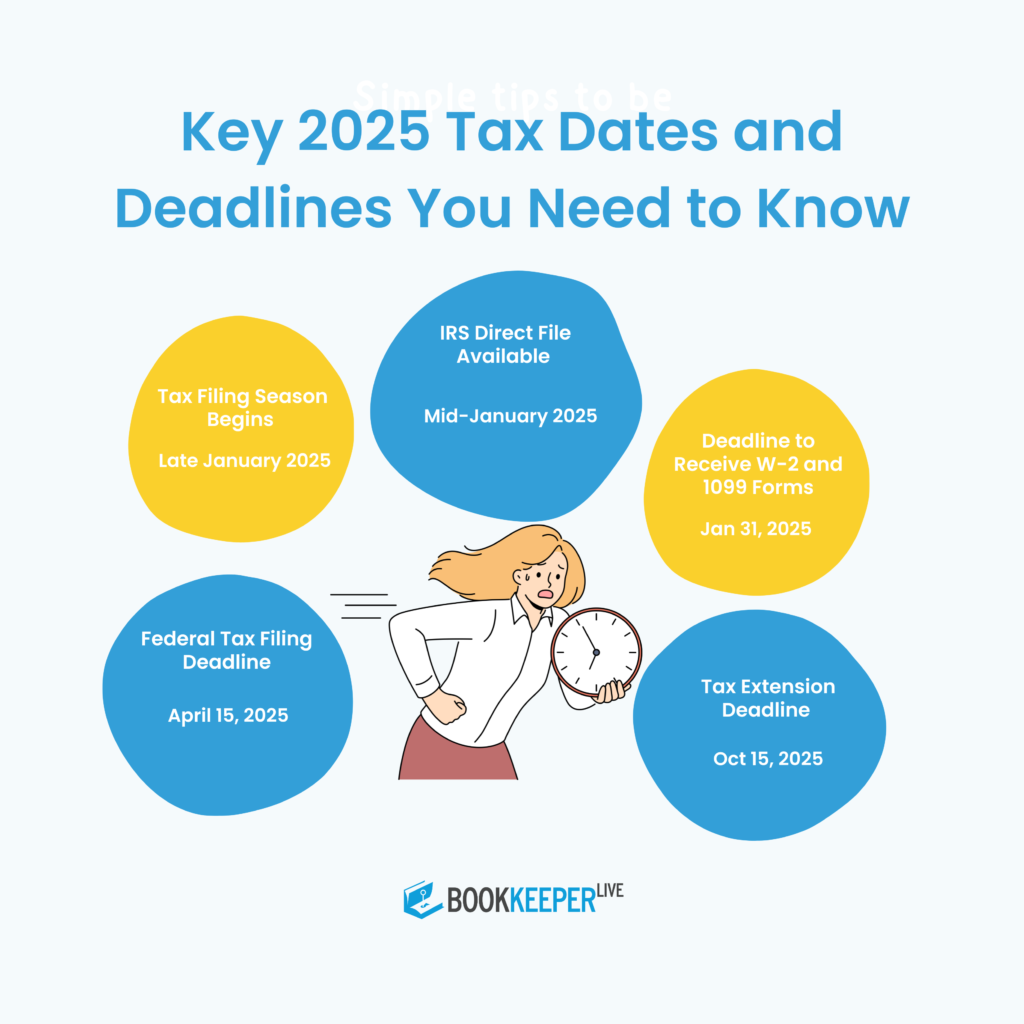

For individual taxpayers, the deadline to file taxes is typically April 15th of each year. However, if April 15th falls on a weekend or a federal holiday, the deadline is extended to the next business day. It's essential to note that this deadline applies to both e-filed and paper-filed tax returns. If you're unable to file by the deadline, you can request an automatic six-month extension by filing Form 4868, which will give you until October 15th to file your tax return.

Business Tax Filing Deadlines

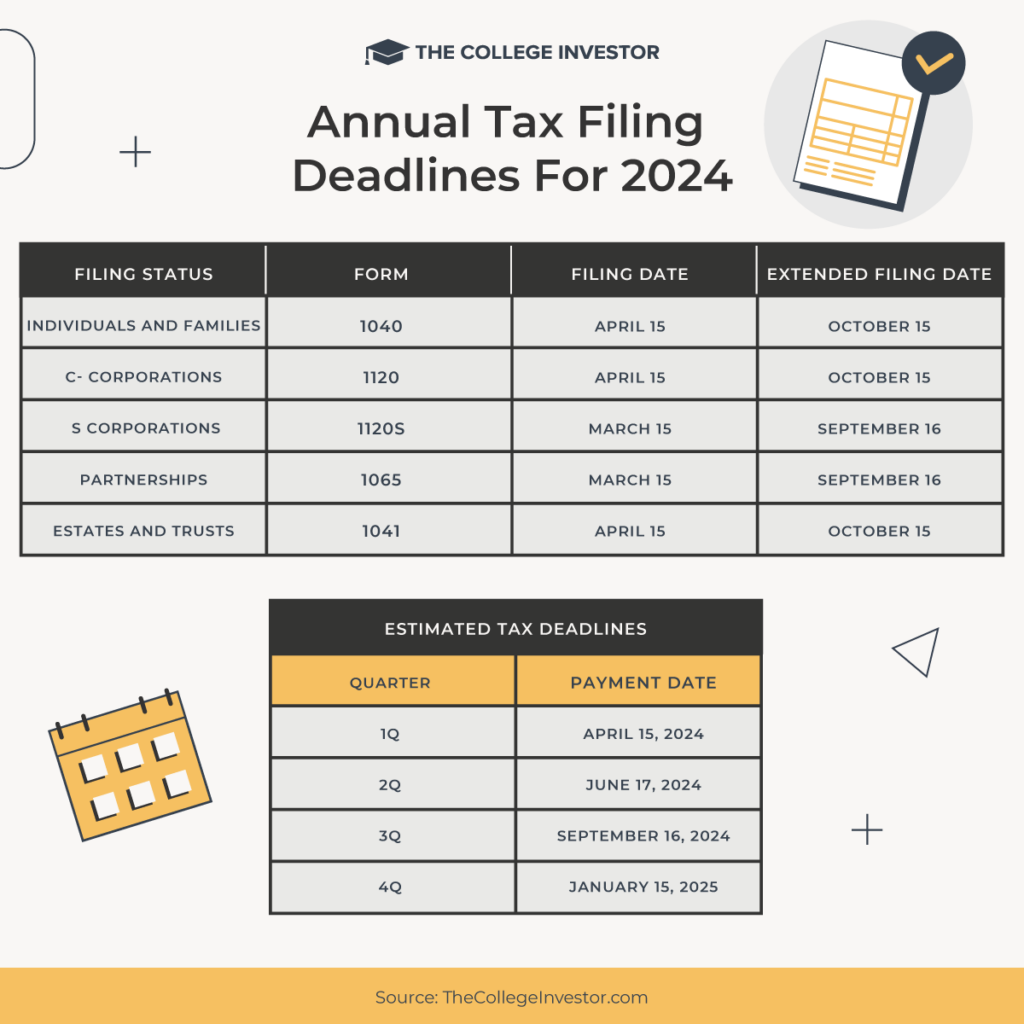

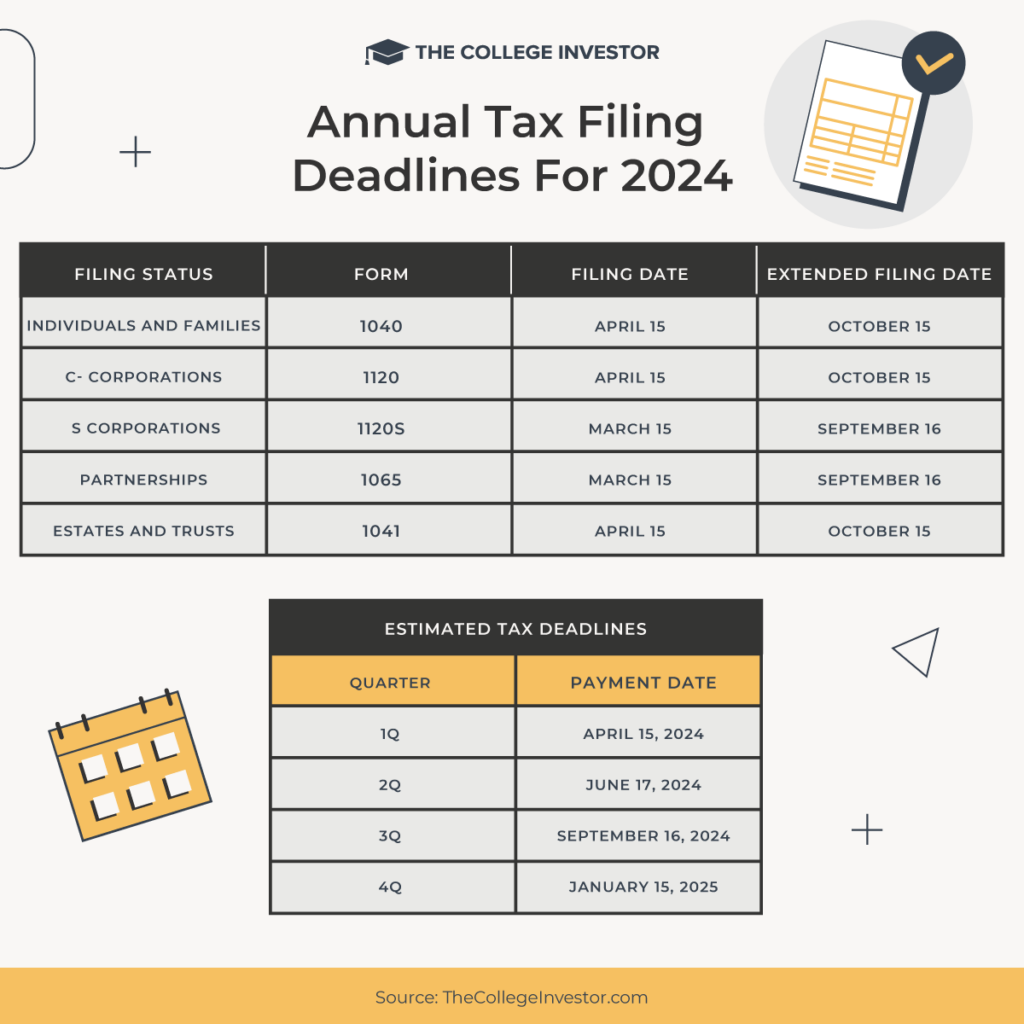

The tax filing deadlines for businesses vary depending on the type of business and the tax form required. Here are some key deadlines to keep in mind:

Partnerships and S Corporations: The deadline for filing Form 1065 (Partnership Return) and Form 1120S (S Corporation Return) is March 15th.

C Corporations: The deadline for filing Form 1120 (C Corporation Return) is April 15th.

Self-Employed Individuals: The deadline for filing Form 1040 and Schedule C (Profit or Loss from Business) is April 15th.

Special Filing Deadlines

There are some special circumstances that may require you to file your taxes by a different deadline. These include:

Amended Returns: If you need to file an amended return (Form 1040X), you can do so at any time, but it's recommended to file as soon as possible to avoid delays in processing your refund.

Extension Requests: If you're unable to file by the deadline, you can request an automatic six-month extension by filing Form 4868.

Disaster Relief: In the event of a natural disaster or other catastrophic event, the IRS may grant an extension of time to file and pay taxes.

Penalties for Late Filing

Failing to file your taxes on time can result in penalties and interest on the amount you owe. The IRS charges a penalty of 5% of the unpaid taxes for each month or part of a month, up to a maximum of 25%. Additionally, you may be charged interest on the unpaid amount, which can add up quickly.

Filing your taxes on time is crucial to avoid penalties and ensure you receive your refund promptly. By understanding the tax filing deadlines and special circumstances that may affect your filing date, you can ensure a smooth and stress-free tax filing experience. If you're unsure about when to file or need assistance with your tax return, consider consulting a tax professional or visiting the IRS website for more information.

Remember, it's always better to file your taxes on time to avoid any complications and ensure you receive your refund as soon as possible. Don't wait until the last minute – mark your calendar and file your taxes by the deadline to avoid any unnecessary penalties and interest.